Copy link to clipboard

Copied

Hello all,

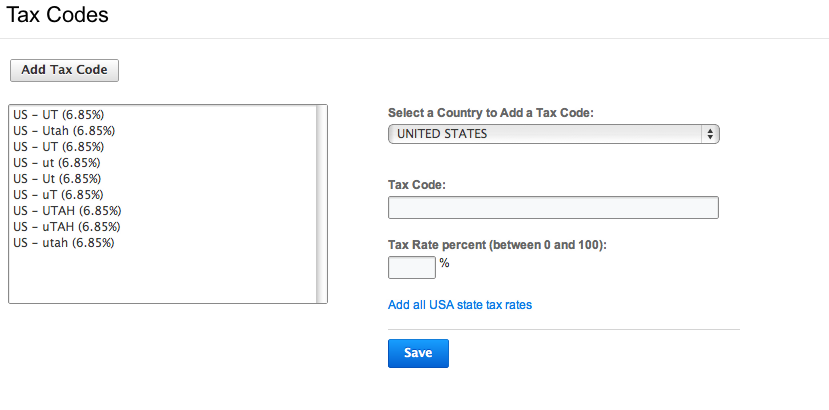

I am working on a site www.ventracing.com for a utah company. when they recieve orders from Utah it should charge them UT state tax which is 6.85%, however despite my best efforts at entering the tax codes properly, the tax is never applied to the orders. Any idea what could be wrong?this is a picture of the tax codes I entered. I entered several abbriviations and capitalizations of UT and Utah. in a effort not to miss any of the potential entries. Any idea why these are not being applied?

1 Correct answer

1 Correct answer

Hi,

The issue here was that you were missing the enablement of "state tax" within you cart layout which needed to have the "true" parameter included in the shipping option tag.

{tag_shippingoptions,true}

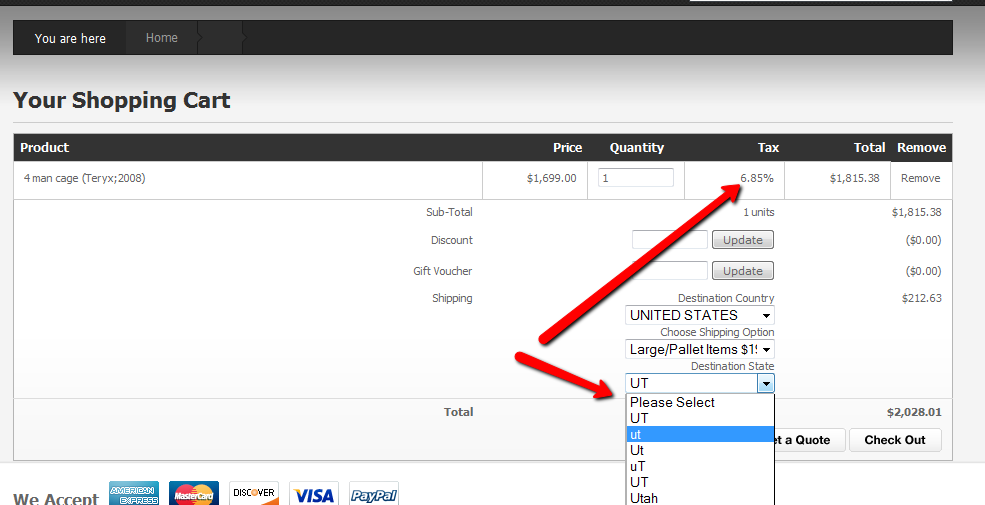

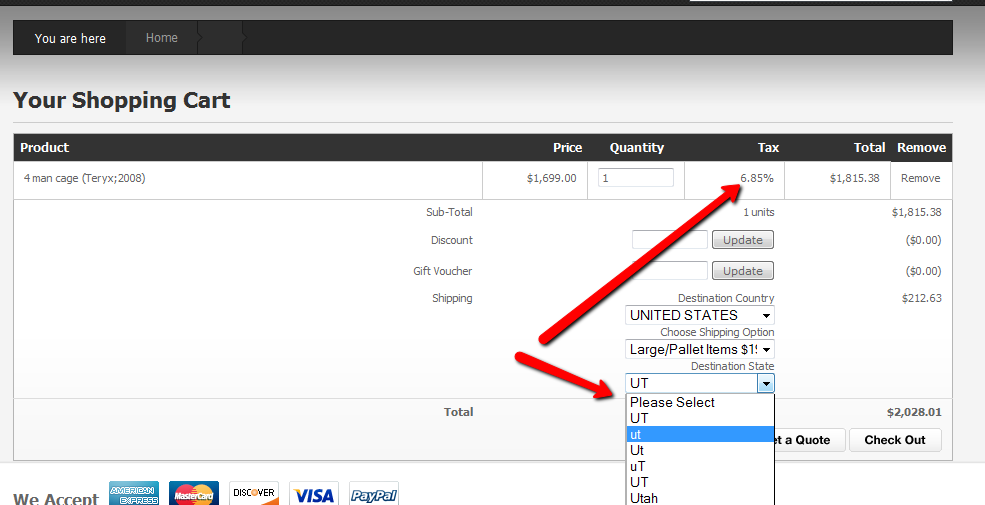

I've since added this for you as the state tax is now applied when the customer selects the corresponding state "UT".

You can go ahead and remove the extra UT tax code to clean up the "destination state" dropdown and include the other states making the tax % equal to 0.

Hope this helps!

-Sidney

Copy link to clipboard

Copied

Hi,

The issue here was that you were missing the enablement of "state tax" within you cart layout which needed to have the "true" parameter included in the shipping option tag.

{tag_shippingoptions,true}

I've since added this for you as the state tax is now applied when the customer selects the corresponding state "UT".

You can go ahead and remove the extra UT tax code to clean up the "destination state" dropdown and include the other states making the tax % equal to 0.

Hope this helps!

-Sidney

Copy link to clipboard

Copied

mitchel,

I need to add all 49 other states with a tax % of 0 in order to just charge it for utah?

Copy link to clipboard

Copied

Add the other states as the state details is needed to have the state tax apply as required.

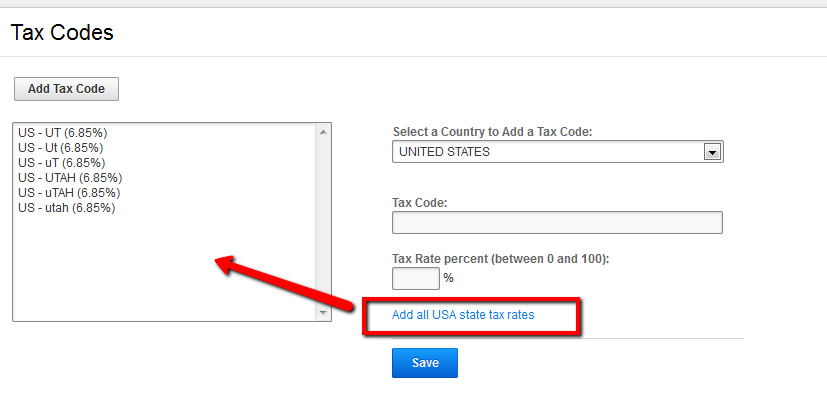

You can click on the add all states link then update all states to "0%" and leave UT with a rate of "6.85%".

-Sidney

Copy link to clipboard

Copied

this process should be made simpler. you need only enter your states of operation. seems unnecessarily laborious, thanks for your help anyway.