Adobe Community

Adobe Community

- Home

- Download & Install

- Discussions

- Re: (LEGAL) WARNING: Adobe India Users - Adobe's G...

- Re: (LEGAL) WARNING: Adobe India Users - Adobe's G...

Copy link to clipboard

Copied

THIS IS A WARNING TO ALL ADOBE INDIA USERS

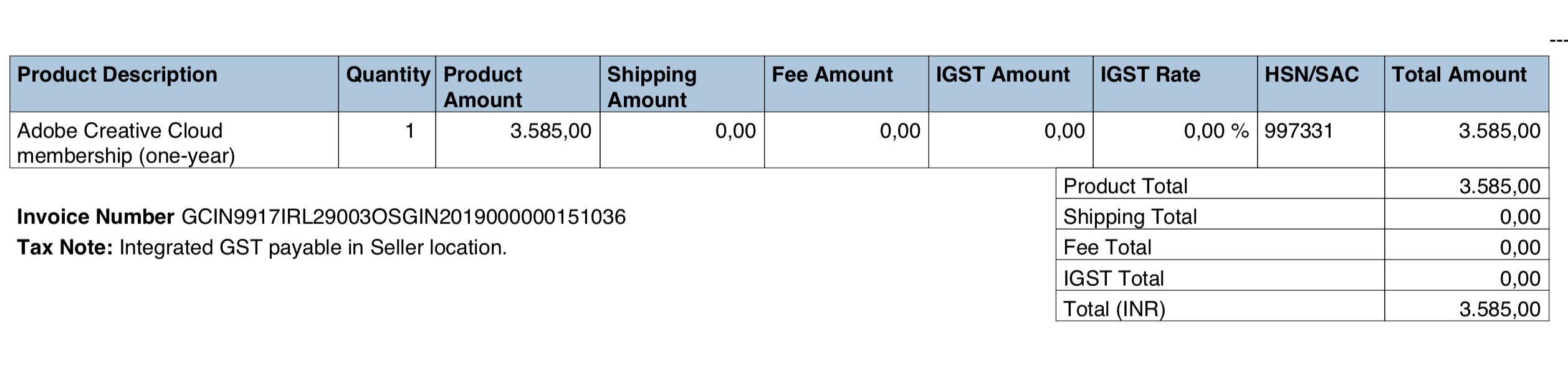

Adobe is illegally charging us a GST of 18% as they are using an invalid GSTID on their invoices. I have contacted them about this multiple times (Case 0222758112) starting with a month ago, and the only responses i get hint towards either not understanding at all how GST in india works, or an intentional tax fraud.

This will result in two things:

1) Business owners will not be able to claim an input credit on the GST paid to Adobe, and

2) Individuals subscribed to the package will be charged an extra Rs/ 608 per month under the purview of tax, but will serve as Adobes profits instead.

Tax fraud anyone?

I am hoping that by bring this to the attention of other users, Adobe will finally take action and educate themselves some more.

There are extremely poor and uneducated people in this country who have grasped the concept of GST MUCH better than a reputed company like Adobe. This is honestly, extremely shameful.

The below are my points to adobe to clarify and educate them.

1) Stating an invalid GSTID on an invoice (as is in your case), is against the law. This comes under illegal without intent.

2) After i have brought this to your attention a month back, and a new invoice has been generated, it now comes under illegal with intent.

3) GSTID on invoice is mandatory, as people who would claim an input credit on the tax will need YOUR correct GSTID to file for returns. The moment we do this with the current illegal ID provided, it becomes a case of tax fraud on the customers part.

4) Once a case of tax fraud is noticed, an inquiry will take place to determine the reason for the same, and all your customers will direct the GST dept to to the adobes invoice.

5) Case of tax fraud gets pushed onto adobe from multiple customers, resulting in a class action lawsuit. This along with the fact that you have illegally issues millions of invoices till now.

1 Correct answer

1 Correct answer

Copy link to clipboard

Copied

Okay. Sorry about that

Copy link to clipboard

Copied

Same issue. This a GST/VAT invoice and it says 0%tax. Customer care is clueless about input tax credit.

Copy link to clipboard

Copied

So, just wanted to take an update here. Was the problem ever got sorted ?

Asha Kanta Sharma

ashakantasharma@gmail.com

-

- 1

- 2