Adobe Community

Adobe Community

Copy link to clipboard

Copied

The subscription charges levied by Adobe also include 18% India GST, without providing Adobe India GST number for the subscriber to take Input Credit. How do we register our GSTIN with Adobe? Adobe should mention respective subscribers GSTIN on monthly invoice. Awaiting response.

Rajinder Arora

1 Correct answer

1 Correct answer

You may check with Adobe support once:

Copy link to clipboard

Copied

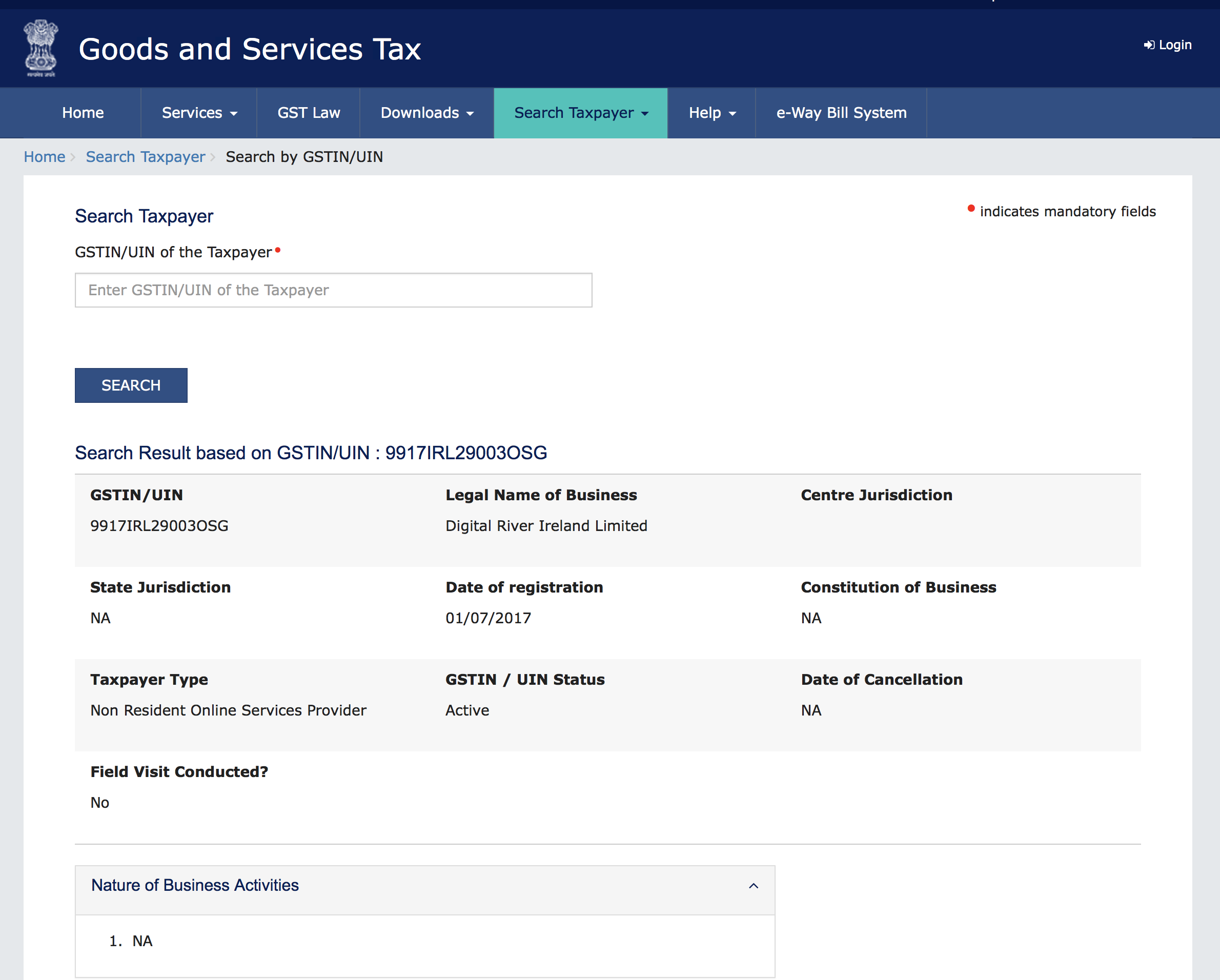

I have validated the GST no on the GST website and its Legit for 'Digital River Ireland Limited'

Copy link to clipboard

Copied

The GST number mentioned in Adobe's invoice is NTT0400IRLSR003 which when validated at https://services.gst.gov.in/services/searchtp gives the number as invalid.

The GST number provided by Adobe Support is 9917IRL29003OSG. When this number is validated at https://services.gst.gov.in/services/searchtp then Tax Filing Status shows as "Not Filed".

If the GST return is not filed then we can not claim/setoff GST.

Kindly advice.

NTT0400IRLSR003

Copy link to clipboard

Copied

This is october month 2018 till the tax filling status is Not Filled. Even customer care not aware of differentiating between Order Receipt and Invoice. There is no option to add the GST Number

Copy link to clipboard

Copied

There is no provision for mentioning the GST on invoices. This is not done. Even the customer care/support guys are clueless. Has ANYONE been able to get an invoice with their GSTIN mentioned on it?

Copy link to clipboard

Copied

Yes mentioning GST Number on Invoice is a must to claim input tax credit in India. It is one of the important legal requirements under GST law. I think one must contact their customer care to get this sorted out..

Copy link to clipboard

Copied

They have sent me an invoice with my GSTIN added in the PDF. The original invoice on Adobe site does not have this GSTIN added to it. Will I be able to claim input credits with that invoice?

Copy link to clipboard

Copied

Hi there,

Yes, you will be able to claim credits with the new invoice which includes your GST number.

Everyone else :

For business purchases, while placing order our website accepts GST number and if entered it will be printed on every renewal invoice. If user misses on adding GST number purchasing they would need to contact customer care to add GST number on the order so next renewal includes GST number.

^Ani

Copy link to clipboard

Copied

Thanks a lot. Does that mean that my next invoice will have the GSTIN printed on it or do I need to contact support every month?

Copy link to clipboard

Copied

Hi there,

Currently I'm unable to add GST number on your active order since it was placed before GST was adapted. However I have logged in a request with Digital River to include it, so you should not have this issue again.

I will update this thread as soon as it is done. #9893

^Ani

Copy link to clipboard

Copied

Okay, thanks a lot, Ani.

Copy link to clipboard

Copied

Hi there,

I have sent you a PM. could you please take a look and let me know.

^Ani

Copy link to clipboard

Copied

Ok I just subscribed for a PS individual license from the adobe India site and keyed in our GSTIN. I find the invoice is issued by Adobe Ireland and no GST has been charged. The invoice at the bottom says "Note:If no tax is charged and your tax identification number is displayed, then this is either an exempt or a reverse charge transaction"

I guess this is being exempt since they are selling this from a different country. Dont Adobe sell this from their India division where they can give us a invoice with their India GSTIN ?

Copy link to clipboard

Copied

We are also planning to buy this for our corporate and we are also registered under GST.

So GST is not being charged by Adove Licenses. Seems all these are sorted out now..

Asha Kanta Sharma

ashakantasharma@gmail.com

-

- 1

- 2